Original Author: Ignas, DeFi Researcher

Translation: Shanooba, Golden Finance

I have a strong bullish feeling about the cryptocurrency market right now. Although I’m unsure about specifics, the market is undergoing significant changes.

Interest rates are beginning to decline, ETH ETFs are approved, there’s an influx of funds into BTC ETFs, and Stripe has launched stablecoin payments…

It’s akin to an army strategizing before a decisive battle; major crypto companies and traditional financial institutions are gearing up for the upcoming bull market.

For more on this “feeling,” read on:

Meanwhile, the inner workings of cryptocurrencies haven’t stopped. Yes, prices are dropping… but the market is always evolving, with new narratives and trends emerging continuously, influencing the market as they gain traction.

Just as MakerDAO was operational before the term “DeFi” emerged, new trends are appearing in the current market. These trends aren’t yet large enough to form a coherent story.

Here are seven emerging trends that could significantly impact the market:

1. Repackaging

Old coins are boring; gamblers want something new.

Imagine renaming a brand, creating a new token symbol, and starting fresh with new charts. That sounds exciting!

Fantom → Sonic

This is precisely what Fantom achieved with its upgrade to Sonic.

Sonic is a new L1 with native L2 bridging to Ethereum. It will feature the new Sonic Foundation Labs and a completely revamped visual identity.

More importantly, the new $S token “ensures compatibility and migration from $FTM to $S at a 1:1 ratio.”

This move is smart because migrating to Sonic generates more market hype than simply calling it “Fantom 2.0”. It allows Fantom to address its multi-chain bridging issues and start anew.

Connext → Everclear

Similarly, Connext is rebranding to Everclear.

Renaming in crypto isn’t new, but the emerging trend here is repackaging significant upgrades as new products.

This sends a stronger signal to the market than just another v2 or v3 upgrade. People are not interested in just another “v4” upgrade.

By transitioning to Everclear from Connext, the team conveys that this is not merely a name change but a significant advancement in technology. Connext evolves from a simple bridging infrastructure to become the first clearing layer. It’s like a chain built into Arbitrum Orbit rollup (via Gelato RaaS) and connected to other chains through Hyperlane and Eigenlayer ISM.

Connecting any chain, any asset, paving the way for modular cryptocurrency futures.

Following this announcement, the NEXT token rose approximately 38% (though not sustained). Fantom’s $FTM surged again, gaining recognition on X as well.

I anticipate more protocols renaming to align with 2024 market trends and technological advancements.

For example, IOTA is renaming itself to L2 for real assets.

Additionally, mergers may become more common, such as Fetch.ai, Ocean Protocol, and SingularityNet merging into one $ASI token, creating a new encrypted super AI project.

The key is to watch the price performance of new branded projects and tokens (if released). While it’s early to say, initial price performances of FTM and NEXT, as well as FET, AGIX, and OCEAN, are optimistic. If the market starts to rise again…

Are more rebrandings/renamings coming soon?

2. Regulatory Support for Crypto

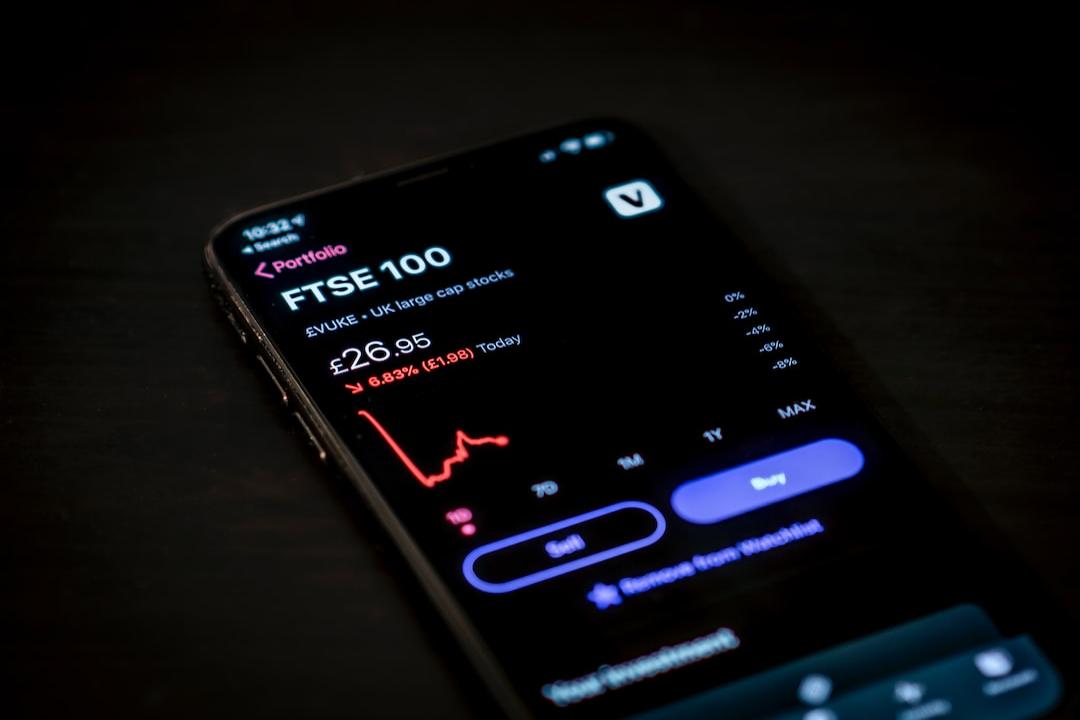

Regulation has always been a major issue, especially in the US, with the SEC targeting major players like Coinbase, Kraken, and Uniswap. While Ripple and Grayscale have had some victories and Bitcoin ETFs have been approved, the regulatory environment remains hostile, focusing more on legitimate projects than outright scams.

But things are changing: Trump vocally supports cryptocurrencies, forcing the Democratic Party to change its anti-crypto stance. Biden accepts crypto donations. Now, the SEC has dropped the lawsuit against Consensys, effectively recognizing ETH as a commodity.

The short-term future of cryptocurrencies now depends on elections. I like Felix’s analysis at Hartmann Capital below.

Here are the main points:

If Gensler is removed or his powers are restricted by courts and Congress, expect a sharp rise in cryptocurrency assets of over 30%, followed by a sustained bull market. If he continues in power, expect a prolonged slump, benefiting law firms while harming cryptocurrencies and taxpayers, with only Bitcoin and meme coins relatively unaffected.

Clear regulation could bring the biggest bull market in history, transforming the digital asset market in several ways:

– Shifting from narratives to product-market fit: Crypto projects will focus on creating valuable products rather than just hype, leading to higher-quality developments.

– Clear success metrics: Valuations will depend more on actual product-market fit and revenue, reducing speculation and highlighting fundamentally strong tokens.

– Easier funding environment: Stronger fundamentals will make digital assets easier to finance, reducing the cyclical volatility of shitcoins.

– Thriving mergers and acquisitions market: Well-funded projects may acquire undercapitalized but valuable DeFi protocols, driving innovation and closer adoption. Some first-tier blockchains will convert acquisitions into public goods to increase network value.

3. BTC Arbitrage Trading: BTC ETF + BTC Shorts

Leverage always finds new ways into the system, whether it’s Grayscale’s “widow-maker trades” or CeFi (Celsius, Blockfi, etc.) unsecured loans.

Each cycle mechanism is different. But where is leverage hiding now?

The obvious target is Ethena’s risk-neutral strategy. As long as the funding rate is positive, everything is fine, but what happens when/if the funding rate turns negative and USDe positions need to be closed?

Another target is LRT’s re-collateralization.

But another target is our beloved BTC ETF buyers.

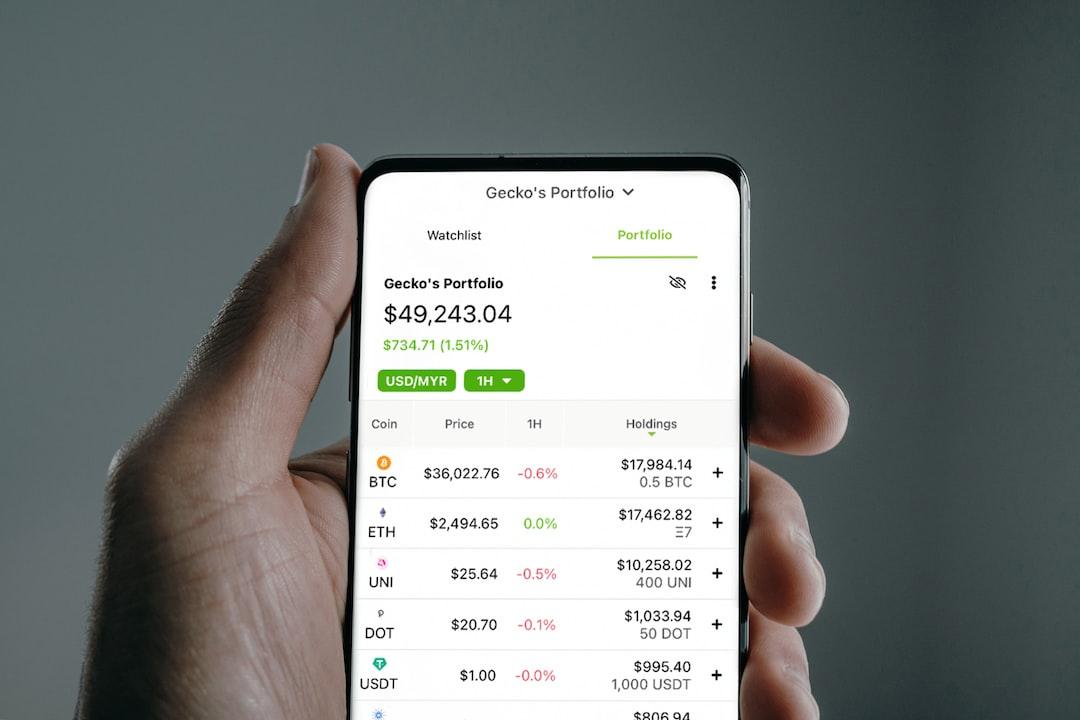

Spot Bitcoin ETFs saw inflows for 19 consecutive days, holding 5.2% of circulating BTC (although this record has now been interrupted).

So why hasn’t BTC skyrocketed?

It turns out hedge funds are record-shorting Bitcoin through CME futures.

“If low funding rates and a lot of leverage exist, what happens in this cycle?” – Kamizak ETH

A plausible explanation is hedge funds buying spot and shorting BTC, engaging in a 15%-20% neutral strategy.

The strategy is similar to Ethena’s. “If low funding rates and a lot of leverage exist, what happens in this cycle?” – Kamizak ETH

What happens when the funding rate turns negative (because gamblers are no longer bullish and close long positions)?

Ethena (dominated by retail investors) and spot BTC + short CME futures (dominated by institutions) could lead to a significant collapse when these positions need to be unwound.

Worrying. But perhaps there’s a simpler answer: institutions arbitraging the positive price differential (currently at 2.3%) between BTC spot and BTC futures.

In any case, these dynamics brought by spot ETFs require close monitoring, as so-called “risk-free” arbitrages often end up being more risky than initially thought.

4. Gamification of Yield Farming

Our addiction to yields is getting worse, but we don’t know how to stop.

Protocols need yields to attract initial user bases. They help boost adoption metrics, securing higher valuations for funding.

We’re tired of yields, but we haven’t found a better alternative yet.

Instead, I’ve noticed a trend of gamifying yield farming strategies, adding extra elements to make mundane yield farm strategies more interesting.

Sanctum introduces Wonderland, where you can collect pets and earn experience points (EXP) to level them up. As a community, you need to unite to complete tasks.

This isn’t vastly different from other token programs, as your airdrop largely depends on the SOL deposited, but… the community loves it!

Sanctum’s first season activity for just one month has already boosted morale. I hope to see 0 to 1 innovations in yield farms, but even with yield fatigue, our addiction to them is too strong.

Instead, I expect more attempts at gamification to bring some fun into farms.

5. Anti-trend issuance with low circulation, high FDV (Fully Diluted Valuation)

Everyone hates low circulation, high FDV issuance. Except for VCs and teams who can sell at higher prices. Oh, and airdrop hunters who get more tokens in airdrops.

But what about retail investors? No. Of the 31 tokens recently listed on Binance, 26 are in the red.

Binance used to be the place to buy hot new tokens, but not anymore. Listing on centralized exchanges is an event to sell news and cash out.

Not surprisingly, Binance recently announced token listings with moderate valuations, prioritizing community rewards over internal allocations.

We haven’t seen rhetoric turn into action yet, but this would be a step in the right direction.

VCs are taking responsibility they should have. Once seen as positive signals, large VC investments are now seen as value extraction by the crypto community. Concerns arise as VCs aim to profit by selling their large allocations acquired at the lowest cost.

Project teams also need to take action to avoid perpetually declining price charts.

There’s also more experimentation by protocol sides. For example, Ekubo on Starknet allocates 1/3 of tokens to users, 1/3 to the team, and 1/3 are sold by DAO within two months. Not everyone likes the two-month sell-off, but it’s somewhat akin to community token sales, reminiscent of past ICOs.

Similarly, Nostra on Starknet launches NSTR with 100% FDV, with 25% distributed via airdrop and 12% sold during liquidity bootstrapping pool activities. They call it the fairest launch in