Title: “Preserving Crypto’s Essence: Embrace Niche Adoption”

Written by: Daniel Kuhn, Deputy Editor of Consensus Magazine

Translated by: Chris, Techub News

In my opinion, keeping cryptocurrencies in a niche market may be the better option.

Undoubtedly, the most significant crisis in the cryptocurrency space to date was the rapid collapse of FTX. At the time, this exchange, later revealed to be Sam Bankman Fried’s personal “treasury,” was the third-largest cryptocurrency exchange globally. Its closure caused shockwaves throughout the industry, not only leading to a significant drop in Bitcoin prices but also dragging down a series of companies.

By the end of 2022, the once-popular and trusted cryptocurrency company was exposed for its blatant fraudulent activities, confirming suspicions that it was all just a cover-up for deceit. While the situation has improved since then, concerns about companies repeating the same mistakes still linger. For seasoned cryptocurrency investors and observers, this kind of situation has become the norm. Ever since the Bitcoin market crash in 2014, followed by the failure of Mt. Gox and its subsequent rebound, the cyclical volatility of the market has been considered a part of life.

But isn’t it strange for a mature industry to view this “boom and bust” cycle as the norm? In my view, any widespread adoption of blockchain or B2C applications depends on the price of its tokens, or else the entire industry will always face the risk of imminent collapse.

This is where the problem lies. To a large extent, the biggest issue with cryptocurrency development is its growth. This alternating cycle of excitement and despair, occurring roughly every four years, is the result of cryptocurrencies’ pursuit of mass adoption.

The consequences of indiscriminate popularity

This process is clearly a textbook example of what economist Robert Shiller calls “irrational exuberance.” The promise of reshaping everything from currency to the internet itself sparked people’s interest, leading them to buy into the decentralized dream (or, for many, the promise of quick profits). Popularity drove up prices, and rising prices, in turn, encouraged more people to invest until something eventually collapsed.

Blockchain technology was originally designed to alleviate or replace certain issues that could lead to failure, which typically exist to make cryptocurrencies more accessible and user-friendly. Many believe that the masses may not be capable of self-custody of cryptocurrencies. However, the core essence of cryptocurrencies like Bitcoin would be lost without self-custody. Measures aimed at making cryptocurrencies more user-friendly or widely accepted often become the root cause of failure as they deviate from the decentralized and self-custodial nature of blockchain.

Alex Thorn, Head of Research at Galaxy Digital Investment Bank, said, “The risk of mass adoption lies in the fact that new entrants may not understand Bitcoin’s core principles: decentralization, self-custody, and sound money. If newcomers do not learn, understand, and accept these core beliefs, these characteristics may cease to exist over time.”

There must be a balance between decentralization and widespread adoption. Mass adoption entails compliance with laws (which often contradicts the values of cryptocurrencies) and the creation of simple entry barriers. If cryptocurrencies become too widely adopted, it’s possible to undermine their genuinely useful features. Nathan Schneider, a media studies professor at the University of Colorado Boulder and author of “Governable Spaces,” said, “Integration into the mainstream financial system will eventually lead to the loss of important features of this technology.”

This viewpoint is echoed by Paul Dylan-Ennis, a lecturer at University College Dublin, who states, “Cryptocurrency is a subculture that refuses to accept that it is a subculture. Most of our problems stem from how ‘welcoming the next billion users’ will lead to the decline of core features.”

The existence of “killer apps”

Developers, founders, and investors have spent 15 years and billions of dollars searching for the “killer app” of blockchain. Ironically, it has been around all along.

Satoshi Nakamoto, along with those who truly follow in his footsteps, have already built tools that are easy to use and not easily taken away.

That is the essence of cryptocurrencies.

This is why hardly anyone uses Bitcoin to buy coffee, but many use XMR to make purchases on the dark web. If you observe how cryptocurrencies are truly connected to the real economy, you will find that they are primarily applied in niche areas. Examples include black markets or gray industries, stablecoin remittance channels, and circulation among cryptocurrency enthusiasts.

Please note that these are massive markets. However, today, as cryptocurrencies seem to be on the brink of a breakthrough, these use cases seem insignificant compared to the speculative use of cryptocurrencies. In speculative use, capital flows in and out, jumping from one coin to another or from one protocol to another, creating a behavior that drives price increases and essentially creating a circular economy.

There’s nothing wrong with that. To some extent, gambling is also a use case. But if people want cryptocurrencies to be used productively, developers, founders, and investors should build products for those who truly need censorship-resistant currencies and tools. It’s almost certain that this is a limited audience.

This is just my opinion, and many people may disagree.

Other perspectives

Molly White, the author of “Web3IsGoingGreat” and “Citation Needed,” believes that “cryptocurrencies have already gone mainstream. While some projects still remain niche, with the events involving Brian Armstrong and Sam Bankman Fried, as well as the launch of Bitcoin spot ETFs by BlackRock and Fidelity, I believe the ship may have already set sail.”

Privacy advocate, educator, and Monero user SETHforPrivacy has a different view. He says, “Unfortunately, most people have yet to realize the necessity of Bitcoin and are not willing to take on so much personal responsibility. Therefore, we must focus on improving Bitcoin to help those who already understand its necessity today.”

Alex Gladstein, Chief Strategy Officer of the Human Rights Foundation, says, “It is decentralization that allows cryptocurrencies to truly go global. The only reason Bitcoin can rise is because it embodies the most cyberpunk traits, belonging to no one and being operated by users rather than governments or companies.”

Emmanuel Awosika, an Ethereum advocate, states, “We believe that everyone wants products that offer privacy, resistance to censorship, and protection against state attacks.”

Awosika adds, “We should explore how to spread cryptocurrencies as widely as possible to more people.” Similarly, Roko Mijic, famous for “Roko’s Basilisk,” believes that it is actually “scale” that empowers decentralized tools, as demonstrated by Bitcoin’s resilience due to miners being distributed globally. “You cannot resist censorship in a small-scale cryptocurrency network because the government will simply destroy the entire network.”

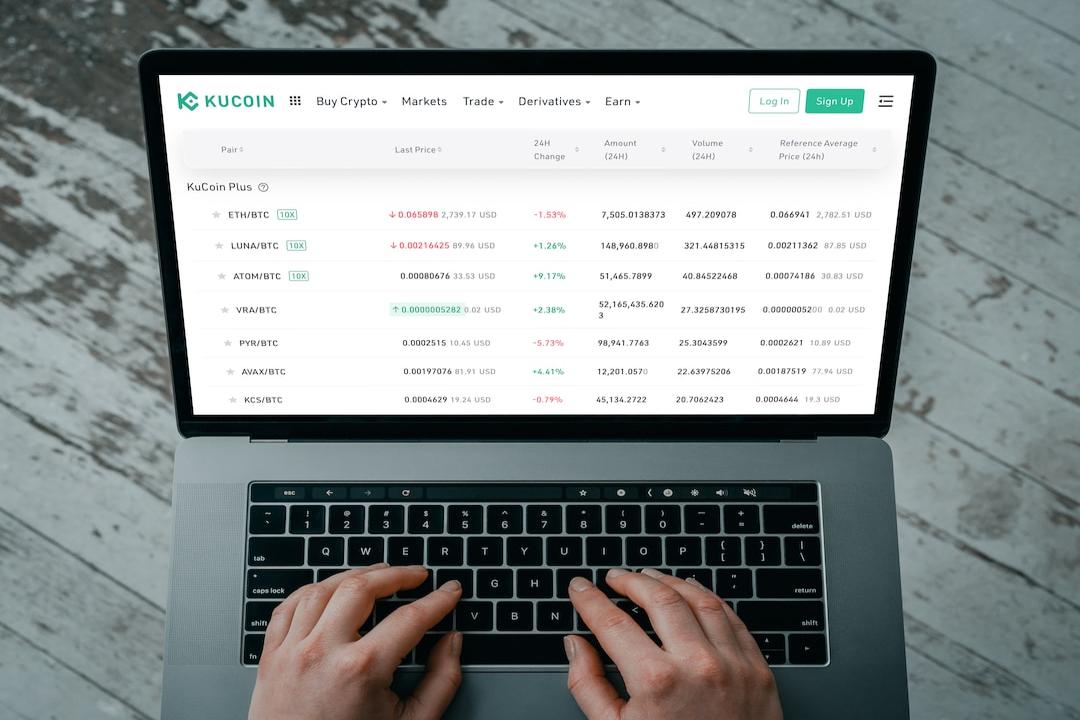

Justin Ehrenhofer, founder of Moonstone Research, agrees with this view and points out that a currency is only useful when widely accepted. Therefore, “the focus should be on building systems that attract external users.” However, he also adds, “With mass adoption, the spirit of cryptocurrencies has degraded as ordinary users store their wealth in custodial exchanges.”

Ultimately, the real question is: “Which is more important, the core values of cryptocurrencies or their widespread application?”